Tesla, Inc TSLA Statistics & Valuation Metrics

Content

60 minutes featuring the brightest minds on Wall Street, taking you through the most important hour of the trading day. The Barchart Technical Opinion rating is a 8% Buy with a Weakening short term outlook on maintaining the current direction. Elon Musk has come on record to explain Tesla’s recent underperformance. Cheaper EV model, robotaxis, and a new Master Plan are expected by analysts at today’s event. The company has $22.19 billion in cash and $3.10 billion in debt, giving a net cash position of $19.09 billion or $6.03 per share. Researching stocks has never been so easy or insightful as with the ZER Analyst and Snapshot reports.

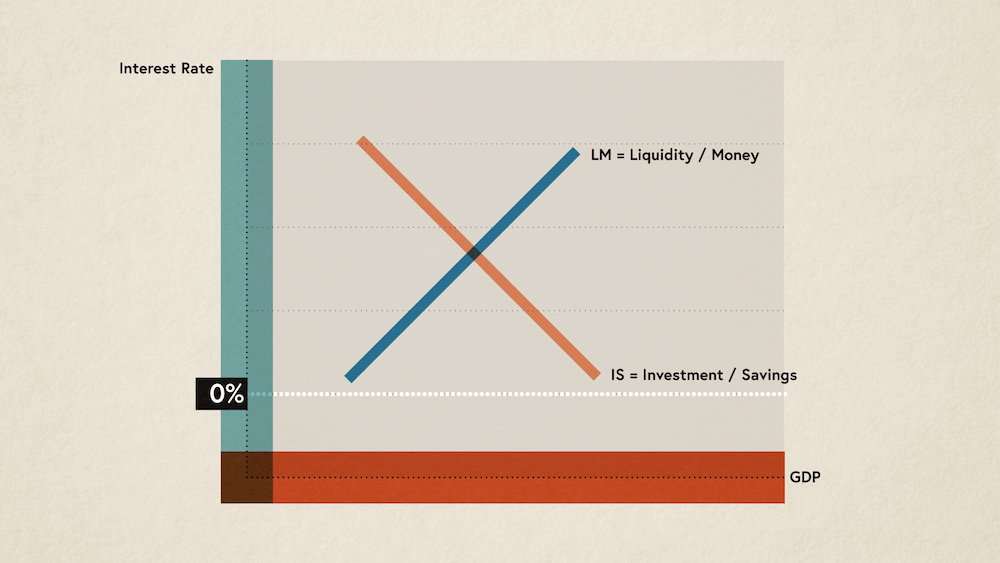

The PE ratio, which divides a company’s market value by its projected earnings, is a crucial valuation measure that investors and analysts use to compare a stock price with its actual earnings. It is the most commonly used metric for determining a company’s value relative to its earnings. In this example, we are using the actual earnings for the trailing twelve months .

BYD Grew EV Sales 2.5 Times Faster Than Tesla in the Latest Quarter

As P/E ratios have inflated, so has the PEG, and a PEG of 1 no longer seems like an accurate benchmark. Many investors like to use the price-to-earnings ratio, which offers a good snapshot for how a company’s price compares to its current earnings. Tesla is the market leader in battery-powered electric car sales in the United States, with roughly 70% market share. Tesla, which has managed to garner the reputation of a gold standard over the years, is now a far bigger…

He thinks a company with a PE Ratio equal to its growth rate is fairly valued. Still he said he would rather buy a company growing 20% a year with a PE Ratio of 20, instead of a company growing 10% a year with a PE Ratio of 10. The PEG ratio isn’t perfect, of course, and divining Tesla’s growth rate, especially five years from now, may be a fool’s errand. tesla pe ratio history But it’s a mistake to discount the company’s growth rate, especially since Tesla has a solid track record of beating analyst estimates in recent years, topping them in 10 of the last 11 quarters. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

Commercial Vehicle

Will Kenton is an expert on the economy and investing laws and regulations. He previously held senior editorial roles at Investopedia and Kapitall Wire and holds a MA in Economics from The New School for Social Research and Doctor of Philosophy in English literature from NYU. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Monitor lets you view up to 110 of your favourite stocks at once and is completely free to use. Provides a general description of the business conducted by this company. This upcoming week has plenty of things to look forward to though as we enter the busy part of the monthly News cycle.

What was Tesla’s PE ratio last 5 years?

Analysis. Tesla's p/e ratio for fiscal years ending December 2018 to 2022 averaged 302.2x. Tesla's operated at median p/e ratio of 52.3x from fiscal years ending December 2018 to 2022. Looking back at the last 5 years, Tesla's p/e ratio peaked in December 2020 at 1,274.1x.

We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. The Price to Earnings Ratio is calculated by taking the stock price / EPS Diluted . This metric is considered a valuation metric that confirms whether the earnings of a company justifies the stock price. There isn’t necesarily an optimum PE ratio, since different industries will have different ranges of PE Ratios. Because of this, PE Ratio is great to evaluate from a relative standpoint with other similar companies.

Tesla Sets a Delivery Record. What Wall Street Thinks.

The company sells solar panels and solar roofs for energy generation plus batteries for stationary storage for residential and commercial properties including utilities. Tesla has multiple vehicles in its fleet, which include luxury and midsize sedans and crossover SUVs. The company also plans to begin selling more affordable sedans and small SUVs, a light truck, a semi truck, and a sports car. The company’s flagship Model 3 is the best-selling EV model in the United States. The firm’s three-pronged business model approach of direct sales, servicing, and charging its EVs sets it apart from other carmakers.

- Investopedia requires writers to use primary sources to support their work.

- You can read more about the power of momentum in assessing share price movements on Stockopedia.

- They are Trailing Twelve Month PE Ratio or PE Ratio , Forward PE Ratio, or PE Ratio without NRI.

- These products and services are usually sold through license agreements or subscriptions.

- You can use Stockopedia’s share research software to help you find the the kinds of shares that suit your investment strategy and objectives.

- This upcoming week has plenty of things to look forward to though as we enter the busy part of the monthly News cycle.

- June S&P 500 futures are down -0.10%, and June Nasdaq 100 E-Mini futures are down -0.61% this morning after three major U.S. benchmark indices rallied on Friday as signs of cooling inflation…

In an article from Morgan Stanley Wealth Management, for example, the PEG ratio is calculated using a P/E ratio based on current-year data and a five-year expected growth rate. The PE ratio (or price-to-earnings ratio) is the one of the most popular valuation measures used by stock market investors. It is calculated by dividing a company’s price per share by its earnings per share.

California Is Boosting Shares of Electric-Truck Makers

If a company can grow its earnings, it takes fewer years for the company to earn back the price you pay for the stock. As a shareholder, you want the company to earn back the price you pay as soon as possible. Therefore, lower P/E stocks are more attractive than higher P/E stocks so long as the PE Ratio is positive. Also for stocks with the same PE Ratio, the one with faster growth business is more attractive.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Bears love to argue that the company is massively overvalued, saying it’s driven mostly by hype, and in some ways that charge makes sense. At recent prices, Tesla has a market cap over $750 billion, while larger automakers like FordandGeneral Motorsare valued at just $48 billion and $51 billion. Tesla’s status as one of the biggest battleground stocks is also no secret.