Branches Of Accounting What is it, Explained, Types, Examples

It’s useful for small businesses and freelancers who don’t have the resources to hire an accountant or bookkeeper. Besides, this frees up time so you can focus on running your business smoothly. Check out our recent piece on the best accounting software for small businesses.

AI, ML and Data Science

Fund accounting keeps track of resources allocated for specific purposes to ensure that government and nonprofit organizations do not deviate from their mission. Fund accounting promotes transparency and accountability in public and nonprofit financial management. Under fiduciary accounting, those accounts are handled and entrusted to the person who takes care of the property’s custody and management. These accountants are responsible for tracking and reporting receipts and disbursements from accounts to ensure proper allocations of funds. This accounting concept helps in improving the administration of the company, enhancing its profit, and providing management with financial reports that leave effects on planning and budgets.

Branches of accounting

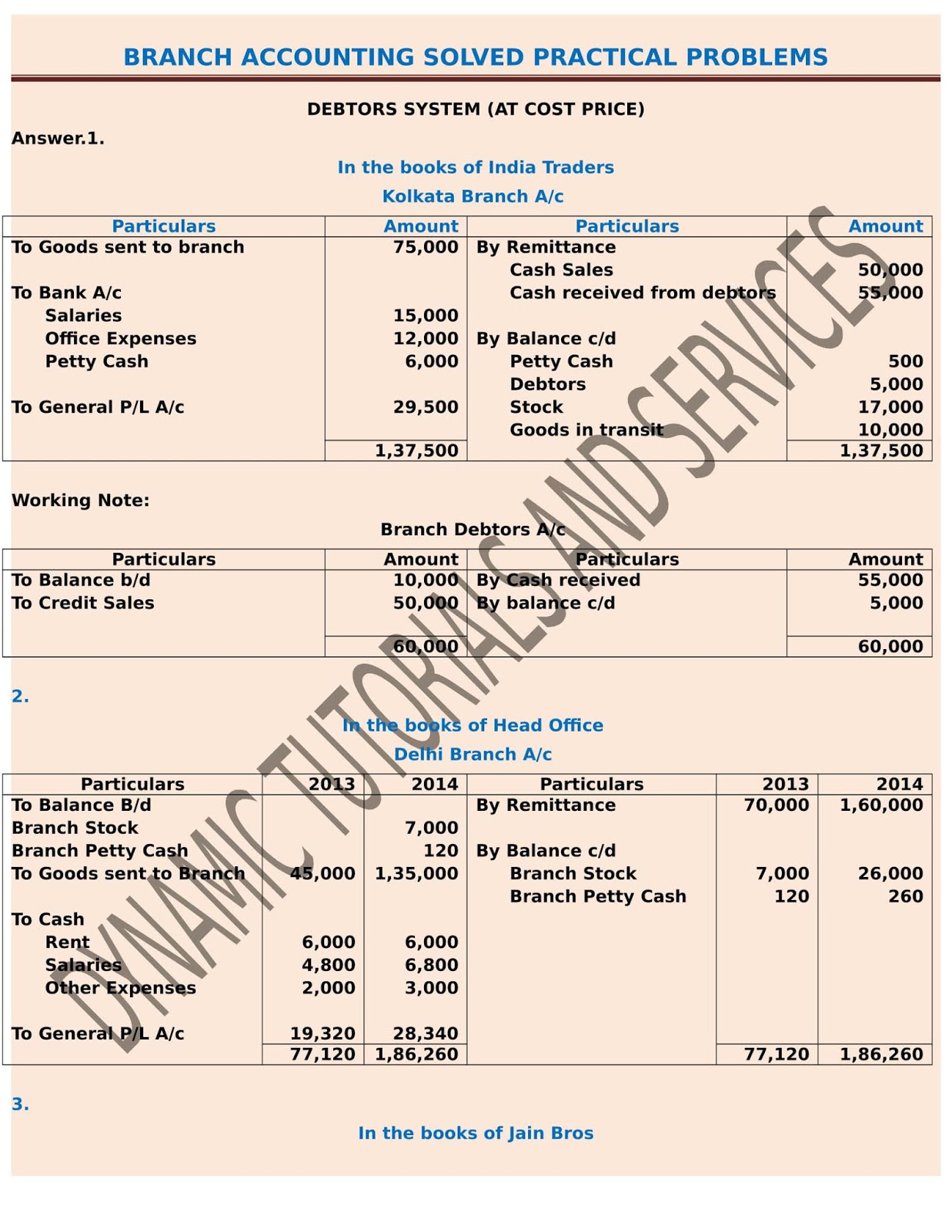

Accounting branches compile data and report results in a variety of ways to stakeholders like investors, creditors, management, regulators, and tax collectors. Financial accounting is concerned with the preparation of periodic financial reports by using historical data about a business best 30 laptop exchange in las vegas, nv with reviews enterprise. Financial accounting involves systematically recording and reporting an organization’s financial transactions for external stakeholders. It differs from other branches by its emphasis on producing financial statements for investors, creditors, and regulatory bodies.

Tax accounting

- International accountants follow GAAP as well as they have enough knowledge in International Financial Reporting Standards (IFRS).

- To create and present reports that inform decision-makers on how to reduce costs or when to spend more, cost accounting examines manufacturing costs.

- Note that such branches follow specific accounting standards set by different organizations, for example, the Financial Accounting Standards Board (FASB).

- The focus here is on generating financial statements like budgets, and product costings.

- Accounting reports a firm’s financial position accurately in the public interest.

Governmental accounting is a specific branch of accounting that deals with the financial transactions and reporting of government entities. This includes both local and state governments, as well as federal agencies. Governmental accounting is unique to other types of accounting in that it is based on different principles and standards.

Cost Accounting

These financial statements can advise the organization’s management team regarding acquisitions, investments, loans, etc. This branch follows the GAAP principles to ensure transparency and accuracy concerning the presentation of financial data. Every branch addresses certain requirements and information within the accounting principles’ framework. Such branches utilize different techniques to gather and report data to management, creditors, tax collectors, regulatory bodies, and investors.

In the U.S., licensed CPAs must have earned their designation from the American Institute of Certified Public Accountants (AICPA). In accounting, you’ll come across certain titles which appear to bear similar duties but actually have unique job descriptions. In this section, we’ll briefly review the roles of accountants vs. CPAs and tax professionals. Internal auditing finds and averts tax problems or readies the company for an external audit.

Government accounting ensures transparency, accountability, and compliance with legal and regulatory frameworks governing governmental financial activities. Cost accounting furnishes management with accurate and relevant financial information for strategic decision-making. This branch of accounting assists in evaluating the efficiency and profitability of business activities by systematically classifying and tracking costs and balance sheets. It enables organizations to identify areas for cost reduction and assess the performance of cost centers.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Standard costing, budgetary control, and marginal costing are some of the dynamic techniques of cost accounting that are widely used nowadays. Financial accounting is the art (or process) of recording, classifying, and summarizing the transactions of financial nature in a systematic manner and interpreting the results thereof.

These types are tax accounting, financial accounting, and management accounting. The process of recording financial transactions that take place in a business is known as accounting. This process includes summarising, analyzing, and reporting various financial transactions.