Cost of Goods Sold Journal Entry in QBO

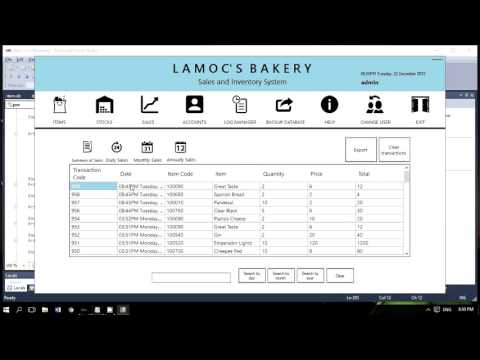

In the next section, we’ll talk more about what each debit and credit means for the sale entry. For example, the inventory cycle for your company could be 12 days in the ordering phase, 35 days as work in progress, and 20 days in finished goods and delivery. All you have to do is enter the cost for each SKU manually and then click the Review button. The blue Resend to QuickBooks button will push this information over to your account.

US: Organic food sales break through $60 billion in 2022 – hortidaily.com

US: Organic food sales break through $60 billion in 2022.

Posted: Fri, 26 May 2023 12:16:12 GMT [source]

We’ll also explore an optional method that can automate most of this process for you! For instance, the cost of goods sold by an automaker would include the material costs for the parts that go into making the car plus the costs of labor used to put the car together. Therefore, the cost of sending the cars to dealerships and the cost of the labor used to sell the car would not be included. Its primary service doesn’t require the sale of goods, but the business might still sell merchandise, such as snacks, toiletries, or souvenirs. Twitty’s Books began its 2018 fiscal year with $330,000 in sellable inventory.

Cost of Goods Sold: Definition, Formula, Example, and Analysis

The cost of goods sold is an important metric on financial statements. It is subtracted from the revenue of a company to determine its gross profit. The gross profit of a company is a profitability measure that evaluates how efficient the company is in managing its supplies and labor in the production process. Cost of goods sold (COGS) also known as cost of sales is the direct cost of producing the goods that are sold by a company. It is the amount that includes the cost of the materials and labor that are directly used to create the goods. Hence, COGS excludes indirect expenses, such as sales force costs and distribution costs.

- You credit the finished goods inventory, and debit cost of goods sold.

- Therefore, the journal entry for the cost of goods sold should equal purchases plus inventory.

- When you purchase materials, credit your Purchases account to record the amount spent, debit your COGS Expense account to show an increase, and credit your Inventory account to increase it.

- The final number will be the yearly cost of goods sold for your business.

- You’ll have to have a basic understanding of the inventory cycle and double-entry accounting methods to make the proper entries.

- Cost of goods sold (COGS) also known as cost of sales is the direct cost of producing the goods that are sold by a company.

You only record COGS at the end of an accounting period to show inventory sold. It’s important to know how to record COGS in your books to accurately calculate profits. You’ll record a total revenue credit of $50 to represent the full price of the shirt. However, the debit to the sales returns and allowances account ultimately subtracts $10 from your revenue, showing that you actually only earned $40 for the shirt. To record a returned item, you’ll use the sales returns and allowances account.

Return of a Sale Entry

The cost of goods sold which is our main focus is treated as an expense account and so would have a natural debit balance as other expenses. The cost of goods sold (COGS) is usually recorded as an expense in the income statement that reports the business’ profits and losses. This financial statement shows the sales, expenses, and net income of the business.

- At a corporation, the debit balance in the expense account will be closed and transferred to Retained Earnings, which is a stockholders’ equity account.

- Therefore, when making a journal entry, the cost of goods sold is debited while purchases and inventory accounts are credited to balance the entry.

- Also, the costs incurred on the cars that were not sold during the year will not be included when calculating the COGS, regardless of whether the costs are direct or indirect.

- Costs of goods sold vary as the number of finished products increase or decreases.

- Depending on the type of account, debits may increase or decrease the account.

- If you need to move amounts from any account to another, all you have to do is to debit one account and credit the other.

By subtracting the annual cost of goods sold from your annual revenue, you can determine your annual profits. COGS can also help you determine the value of your inventory for calculating business assets. To account for the cost of producing the items sold, ending inventory and COGS are both debited, and at the same time purchases and ending inventory are credited.

Cost of goods sold and small business tax returns

We rave about A2X in several of our videos; it makes a whole lot of accounting processes much simpler. An allowance is a price reduction on an item, often because of a sale or a flawed item like a floor display model with a dent. Understanding the meaning of each debit and credit can be tricky when you’re dealing with returns. Credit your Inventory Recording A Cost Of Goods Sold Journal Entry account for $2,500 ($3,500 COGS – $1,000 purchase). Depending on the size and complexity of the business, a reference number can be assigned to each transaction, and a note may be attached explaining the transaction. You’ve successfully updated your profit and loss statement in a way that makes predictions much more sustainable.

For more information on costing methods for your inventory, read 3 Inventory Costing Methods. Let’s review what you need to know about making a sales journal entry. But it’s still important to make sure that there’s an accounting record of every sale you make. This way, you can balance your books and report your income accurately.

The Steps for Recording COGS in a QuickBooks Online Journal Entry

The corresponding credit is to accounts payable, a liability account. When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference between your COGS Expense and Purchases accounts.

The first step for how to record a cost of goods sold journal entry_is to gather the information needed to calculate COGS. This information will be https://kelleysbookkeeping.com/how-to-make-a-balance-sheet-using-a-simple-balance/ found in various general ledger accounts. The beginning inventory balance will be the total of the inventory asset accounts in the general ledger.